When we think of relationships, we often refer to them as something that connects us with people. As I live a minimalist life, I learned that we all have relationships with different things, including money.

At this point, I would like to think that my relationship with money has improved. I have my savings and insurance in place, my credit cards are always paid in full and on time, and I can enjoy little everyday luxuries.

When I was younger, I was once in that phase when I didn’t know how to handle my money – especially when I was still a student.

My good relationship with money is something that I have developed as I started earning money from working/trading my time, selling my skills and expertise, and re-selling goods. But just like in every relationship, I make sure that this is something that I nurture and maintain.

An unhealthy relationship with money can look like this:

- unpaid credit card bills

- refusing to talk about money or financial literacy

- feeling guilty about spending or treating one’s self

- resenting financially secured people

Sharing some tips on how to build a healthy relationship with your money.

- Be more self-aware. Being aware and understanding our own emotions, preferences and biases can help us in making decisions, especially when it comes to money. Understanding ourselves will make sure any investment or purchases that we make align with our values. I personally love to spend on experiences so I make sure that I save for my Travel Fund. While some people I know love to collect luxury bags, others invest in gaming consoles and toy collectibles. We all have different preferences with how we spend our money and there is nothing wrong with that.

- Understand your money history. We all came from different backgrounds, and most do not have “old money” or generational wealth. Understanding our money history will help us “heal” unjust tones about money and help us manage our finances well.

- Sharpen your financial literacy. There are a lot of helpful materials online that provide information about financial literacy including the importance of saving, managing cash flow, and investing. Putting the knowledge into action is the key to mastering financial literacy and ensuring a step closer to financial freedom.

- Establish a clear financial goal. Make a small step to reach your financial goal. It could be paying off your debt first, strengthening your emergency fund, or saving up for a big purchase. When you have a clear goal, you can list down things that you can do to achieve it like sticking to a budget and living below your means.

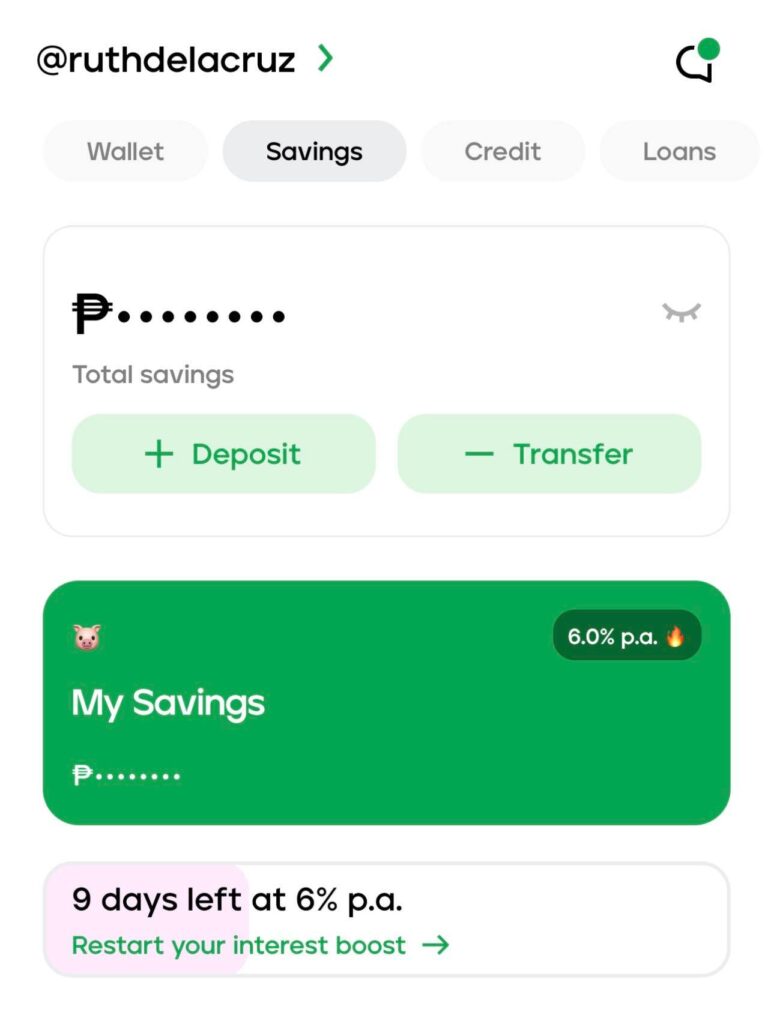

- Make your money work for you. No matter how good we are at what we do, it is important to understand how our money can work for us. One of the apps that help me have a strong and healthy relationship with money is the Maya app. I use the Maya app to pay my bills, save and grow my money.

Maya offers higher savings interest to its users compared to other traditional and even digital banks. Although they initially offer a 4.5% interest rate p.a. (which I think is already high versus traditional banks!), Maya users are entitled to boost it up to 6% for another 30 days just by paying with Maya [Link out to: https://www.maya.ph/deals/savings/boost-your-interest-to-6-with-maya-savings-when-you-pay-with-maya-2022-december]. Just pay via QR, card, or mobile number, settle bills, or buy mobile telco load) for an accumulated spend worth at least Php 250. To know more about Maya’s latest offers, check out maya.ph/deals.

Aside from Personal Goals, where you get a guaranteed 6% interest p.a, Maya’s newest feature is the Personalized Username. I love that the Maya app keeps its fun personality by introducing usernames. This is a game-changing feature that lets you send and receive money with your very own username — another first-of-its-kind feature from the leading digital bank and fintech in the country. This feature gives users a convenient and safe way to send money – instead of memorizing the number or revealing one’s real name. This is also a good branding feature for those with small businesses or for freelancers like me.

They say that when you treat your money well, the more money you get in return.

I am still on this journey to a stronger and healthier relationship with my money. I hope we all find the right balance in how we enjoy our money without compromising our needs.

If you haven’t yet, download Maya—your all-in-one money app at the Apple store and Google Playstore. And follow Maya on Facebook for more updates. To know more about Maya’s latest offers, check out maya.ph/deals.

Related Read