When our Korean visa was approved, we knew we needed to fly and use it within 60 days. We were granted a Single Entry Visa, and we were afraid that if we didn’t use it, we might not get approved the next time we applied – just like what happened to me previously when I got a multiple-entry visa but didn’t use it (but that’s for another story time!).

I didn’t want to touch my savings (because I’m keeping them for a more important trip next year), and while I had credit cards I could use, I knew I needed on hand cash, too.

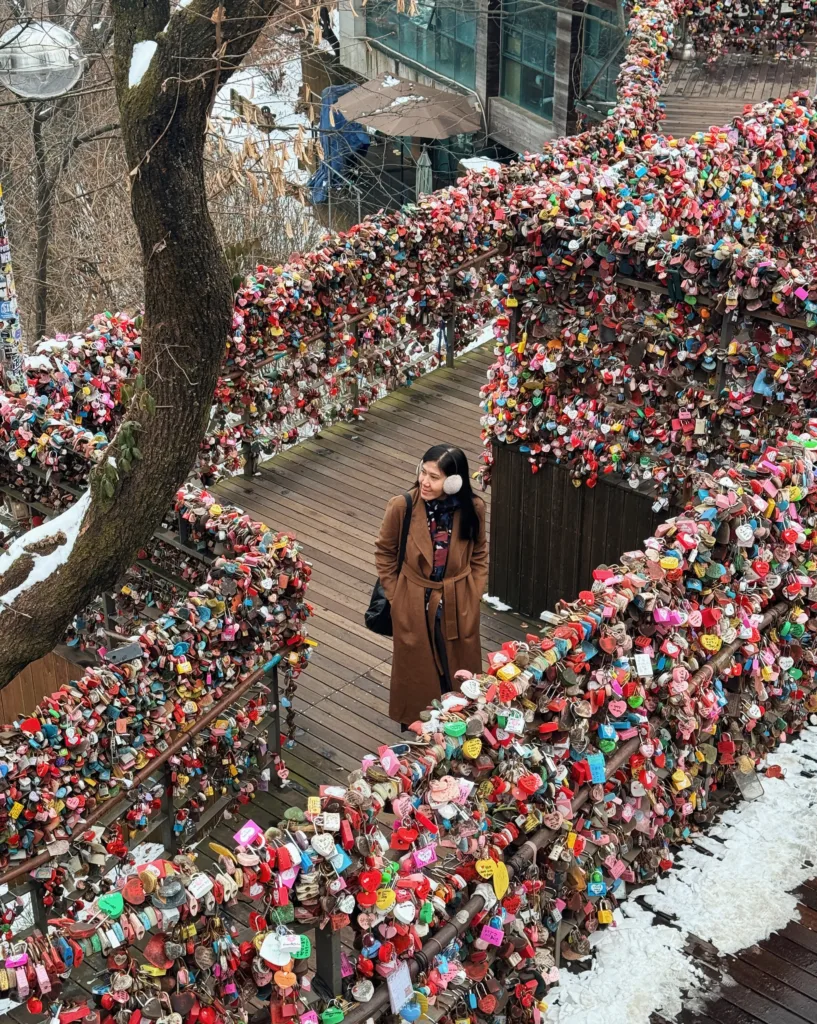

I’m grateful that I get to travel every now and then, but it’s far from cheap. Add the last-minute booking, peak season rates, mandatory travel requirements, and winter clothing (we were expecting to fly during Fall Season, but Winter came early in Korea). Expenses incur even before we check in and post a social media update.

I had two choices:

- Say no to the trip and wait again (with zero guarantee of approval next time), or

- Find a way to make it work.

Thankfully, Maya keeps things fast, digital, and stress-free. No waiting for weeks for approval – just instant access to cash, whether it’s for everyday needs or big moves. Maya Personal Loan lets you borrow up to Php 250,000, payable in up to 24 months. It’s perfect for major purchases, home upgrades, business investments, or even that much-needed dream vacation. Plus, you can get a chance to win Php 1 Million and share another Php 1 Million with a friend! Instantly earn 5 raffle entries for every P1,000 you spend or borrow with Maya for your upcoming holiday expenses!

HOW TO APPLY FOR A MAYA LOAN

- Open the Maya app and go to the Loans section.

- Choose your loan amount and term.

- Upload a valid government ID and proof of income.

- Submit and wait for approval.

- Once approved, the loan amount will instantly be disbursed in your Maya Wallet.

The monthly interest rate depends on your credit rating, starting at 0.77%.

My Maya Wallet was linked to my Maya Card, so I could use the card for purchases or withdraw cash from any ATM.

To repay the amount, just set – up automatic deductions to not forget due dates; and you can also access Loan balance, due dates, and payment history.

WOULD I RECOMMEND TAKING A LOAN FOR TRAVEL?

It depends.

Take a loan for travel if:

- It’s a rare opportunity (visa window, scholarship, family event, long-awaited approval)

- You have a stable income to repay it comfortably (or you have an upcoming receivable payments from your freelance gig like me)

- You have a realistic repayment plan

Don’t take a loan if:

- You have no incoming money or receivables

- You’re already drowning in debt

Traveling because of a suddenly approved visa can feel both exciting and chaotic; but you can always find way to make it work.

Just make sure that you still stay responsible when wanting to experience life.