Tonik Digital Bank: How to Open Account, Interest Rates + Cash In / Cash Out Fees

Here’s an exciting news, saving and digital banking can this be fun and exciting.

Tonik, Southeast Asia’s first digital-only bank, launches as the first neobank in the Philippines. Tonik brings to the market a revolutionary and completely branchless way of banking on a highly secure mobile platform that sets out to fundamentally disrupt the Filipino retail banking industry. Tonik is supervised by the Bangko Sentral ng Pilipinas (BSP). Its deposits are insured by the Philippine Deposit Insurance Corporation (PDIC).

Tonik is led by a veteran senior team who have previously built and scaled multiple digital and retail banks and fintechs across global emerging markets, with support and R&D functions based in Singapore and Chennai, India.

Tonik Digital Bank Features

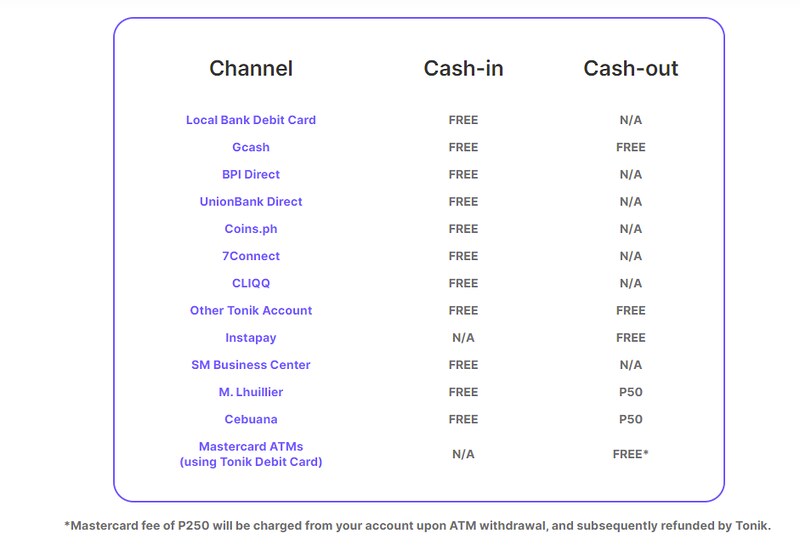

Check out below for cash in and cash out fees: